Washington Sales and Use Tax Exemptions for Medical Products Purchased by Hospitals

Washington sales and use tax law considers hospitals and health care facilities to be the consumers of the medical supplies and equipment used in providing medical services to patients. The Washington sales and use tax exemptions that apply to certain purchases do so based upon the use of the item in question.

Washington Sales and Use Tax Exemptions

Prescription drugs for human consumption are exempt from Washington sales and use tax. There is a three-pronged definition a substance must meet in order to be defined as a “drug” under sales and use tax law. First, it must be a substance that is listed in the official United States pharmacopoeia. Second, it must be intended for use during the diagnosis, cure, mitigation, treatment or prevention of disease. Third, the substance must affect the structure or function of the body. Products which are intended to supplement a patient’s diet such as: vitamins, minerals, herbs, amino acids and supplements would be considered “dietary supplements” rather than “drugs.” Over the counter drugs and dietary supplements would generally be subject to tax unless they are dispensed to patients pursuant to a prescription or under a doctor’s order.

Laboratory Reagents or Other Diagnostic Substances

Purchases of laboratory reagents or other diagnostic substances may be considered “drugs” under certain circumstances. In order to qualify as “drugs” and thus for the corresponding Washington sales and use tax exemption, the laboratory reagents or other diagnostic substances must physically interact with a specific patient’s specimen to qualify for exemption. Laboratory reagents or other diagnostic substances used solely for the preparation of specimens that do not produce a chemical reaction resulting in the detection, measurement, or production of another substance merely facilitate or enable testing and are not exempt from Washington sales and use tax. Examples of taxable purchases include: electrodes; test tubes, slides or other media that do not contain reagents; and acids or chemicals used for cleaning of laboratory equipment.

Disposable or Single-Use Devices

Under

WAC § 458-20-18801 disposable or single-use devices used to deliver drugs to patients are tax exempt. Examples include: needles, tubing, syringes, and IV catheters. Durable medical equipment would not qualify for the exemption because it can stand repeated use and therefore cannot be characterized as disposable or single-use devices.

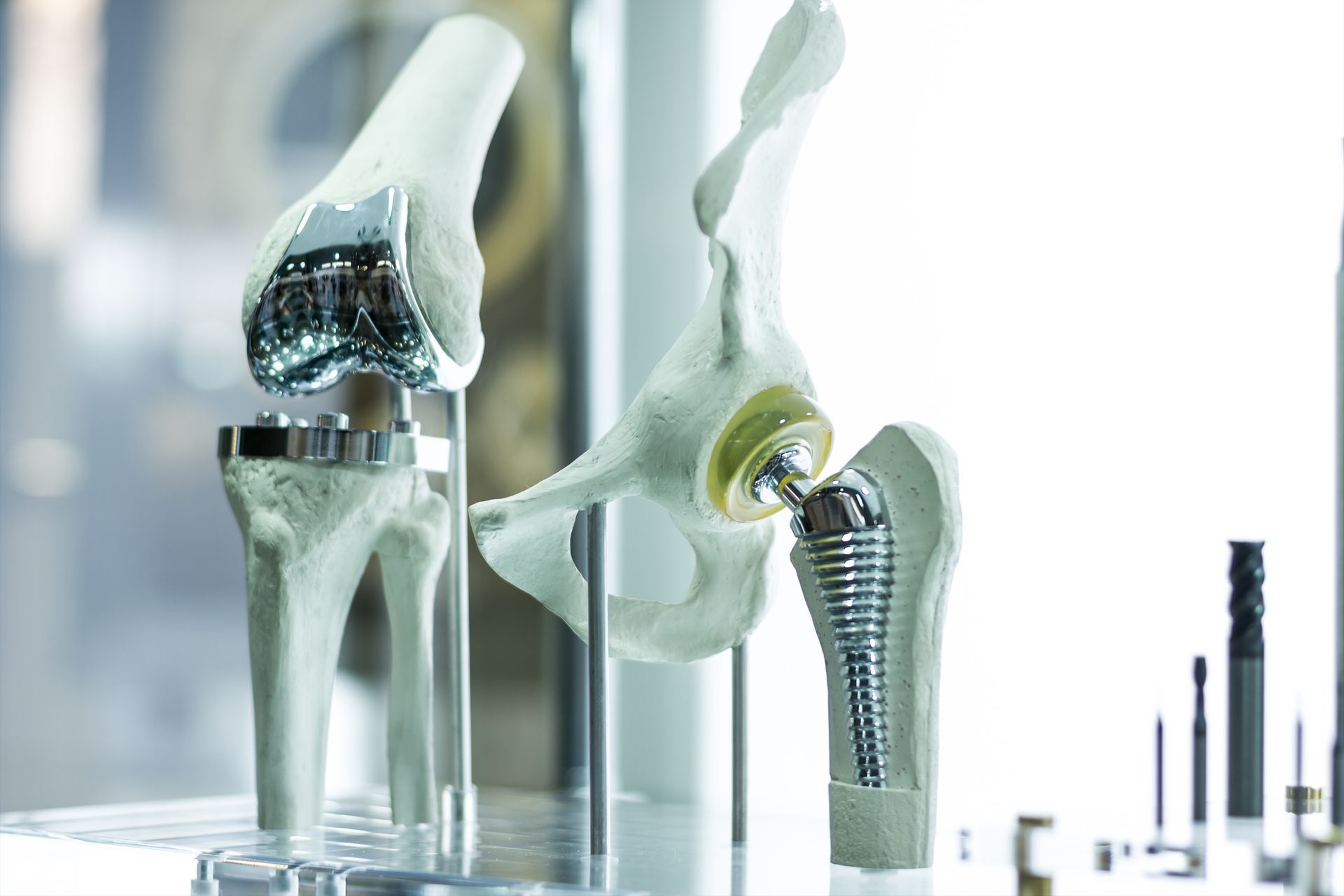

Prosthetic and Orthotic Devices

Prosthetic and orthotic devices are not subject to Washington sales and use tax. Prosthetic devices are replacement, corrective or supportive devices worn on or in the body to replace a missing body part or prevent or correct a physical deformity, malfunction or support a weak or deformed portion of the body. Repair and replacement parts for prosthetic devices are also not subject to sales and use tax. Orthotic devices including braces, casts and splints which supplement or activate weakened body part or functions are not subject to sales and use tax. Ostomy products including related supplies and consumables such as creams and germicides also fall under the prosthetic and orthotic device exemption.

“Bundled Transactions” of Medical Kits

The state of Washington has provided specific instructions for the taxation of “bundled transactions” which, for hospitals, are most often medical kits or trays containing a group of distinct and identifiable products sold for a single non-itemized price. Whether the medical kit or tray is subject to Washington sales and use tax depends on whether the predominant cost of the items within the medical kit or tray are taxable or non-taxable products. If more than fifty percent of the cost of the kit is attributable to taxable products then the entire cost of the medical kit or tray is subject to Washington sales and use tax. Alternatively, if fifty percent or more of the cost of the kit is attributable to non-taxable products then the entire cost of the medical kit or tray would be exempt from Washington sales and use tax.

Non-Profit Organizations

Unlike some other states that provide broad exemptions for nonprofit taxpayers, there is no general Washington sales and use tax exemption for nonprofit organizations. There are some limited exemptions for nonprofit entities from Washington sales and use tax.

RCW §82.04.050(2)(a) provides an exemption for laundry services to all nonprofit health care facilities. Additionally,

RCW §82.08.02795 provides a Washington sales and use tax exemption to free hospitals. Free hospitals are those to do not charge patients for the health care provided. A list of free hospitals and clinics can be found at

Washington Health Care Access Alliance .

Agile Consulting Group

As with all sales and use tax research, the specifics of each case need to be considered when determining taxability. Additional advice from Agile Consulting Group’s sales tax consultants can be found on our page summarizing

Washington sales and use tax exemptions . If you have questions, comments or would like to discuss the specific circumstances you are encountering regarding this particular issue or any other sales and use tax issue, please contact an Agile Consulting sales tax consultant at (888) 350-4TAX (4829) or via email at

info@salesandusetax.com.

The post Washington Sales and Use Tax Exemptions for Medical Products Purchased by Hospitals appeared first on Agile Consulting Group.

GET IN TOUCH

3295 River Exchange Dr., Suite 425

Norcross, Georgia 30092

info@salesandusetax.com

(888) 350-4829

STAY CONNECTED

Join our newsletter and find out more

Contact Us

We will get back to you as soon as possible

Please try again later

All Rights Reserved | Agile Consulting Group